In Missouri Northeast, we understand that site selection is about much more than logistics and workforce. To make our region more attractive to industries looking to grow their business, we have developed a portfolio of incentive opportunities that can be leveraged to overcome any obstacles you might face in siting your business here with us. Our region is eligible for many federal and state-level incentives that can often be packaged with our multitude of local incentives to create the most attractive opportunity possible. Opportunities include tax credits, abatements, exemptions, and low-cost access to financing for infrastructure and building expansions.

Our economic development professionals are happy to explore opportunities for your business to leverage incentives from any level. To learn more about eligibility, timing, and approval processes, please contact the local economic development office.

Incentives and Tax Credits Enhance Your Profitability

We want you to do business here with us and we are working hard to facilitate opportunities where you can have a high expectation of return on your investment. Missouri has one of the nation’s most business-friendly tax climates and Missouri Northeast is prepared to accentuate that advantage with targeted incentives to protect your investment.

State and Local Incentive Programs

Missouri Northeast is a perfect location in North America to invest in a business. The area offers numerous competitive incentive programs to assist in developing one's business. The taxes in the Missouri area are favorable hence attracting business people in the area, and the federal programs are also good and the local incentive programs. Local incentives programs are complimentary and attract local and international investors to Missouri.

Each business prospect is unique, and Missouri Northeast is ready to help you find an incentive package tailored to your specific needs. Whether it is help with land acquisition, withholding tax rebates, sales tax exemptions on equipment purchases, real property tax abatement, or tax increment financing for infrastructure expansions; Missouri Northeast can help you seize the opportunity to move your business forward.

Taxes in Missouri are favorable providing considerable benefits to area businesses. State and Local incentive programs also integrate well with Federal assistance. These complimentary incentives attract local and international investors to Missouri.

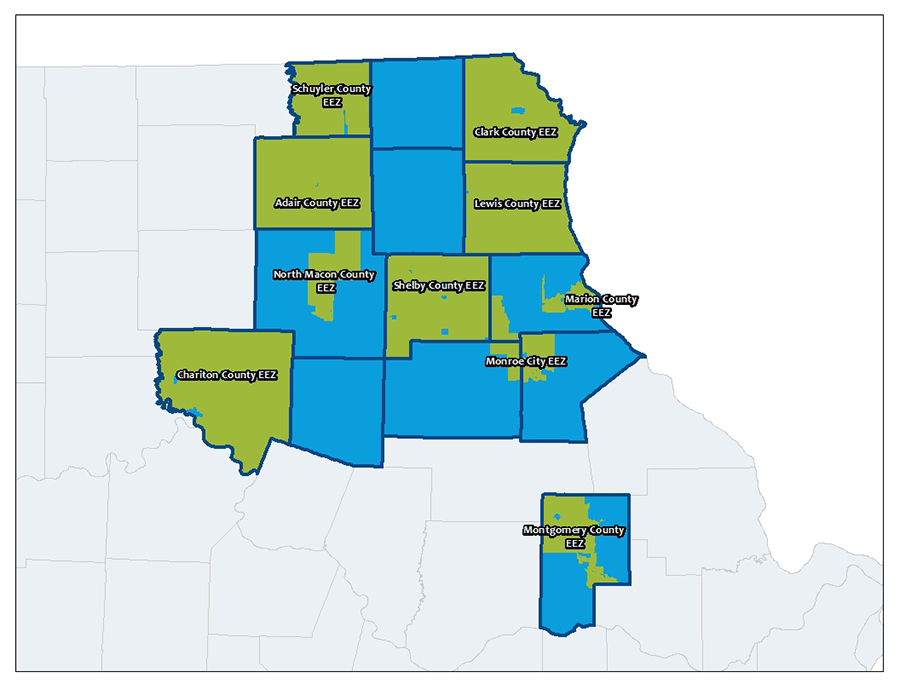

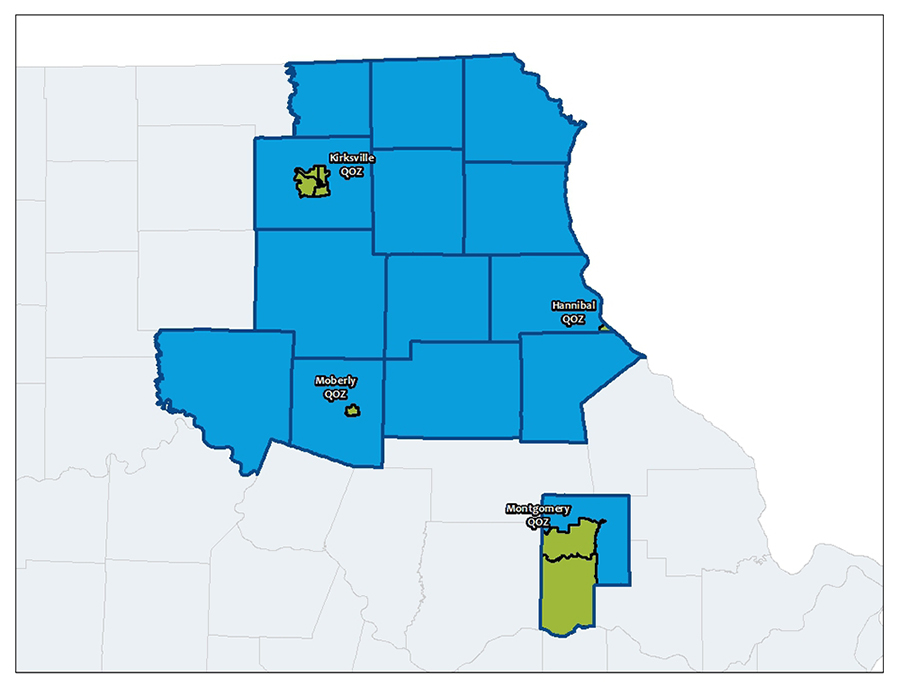

Incentive Zones

Missouri Northeast contains a variety of zoned incentive programs, including Opportunity Zones and Enhanced Enterprise Zones (EEZ). The maps below illustrate the general location of these zones. Please contact the regional economic development professional for that area to learn more.